Affiliate Marketing

3 Keys To A Successful Crypto Affiliate Program

Launching an affiliate program is one of the best ways for SaaS companies to gain traction in the market, especially in the early stages of growth.

This is particularly true for crypto startups and other blockchain-related services in today’s day and age when crypto, blockchain, and NFTs are booming.

But how exactly do you launch a successful crypto affiliate program in today’s crowded market? How do you stand out and compete with so many companies out there trying to do the same as you?

Besides some of the more obvious steps you can take like setting clear goals for your affiliate program, studying your competition, and doing the corresponding SWOT analysis of your company (strengths, weaknesses, opportunities, and threats), the single most important aspect of your affiliate program will be to find and attract the right affiliates or publishers.

In this post, I’ll be sharing my insight as a publisher to provide 3 keys that will help find the right affiliates to target and tilt the balance in your favor in the eyes of publishers looking for the right affiliate program.

But first, you should run some numbers to determine if an affiliate program makes sense financially. Keep reading to find out how to do that.

Know your LTV and CAC

Suppose you’re in charge of growing the user base of a relatively new crypto exchange. If you’re serving a major market like the United States, your potential users will have plenty of options to choose from. Even if you’re serving a smaller market like Australia or Canada, there will still be dozens of other crypto exchanges you’ll need to compete for customers with.

At this stage, then, allocating your resources efficiently and retaining your customers for as long as possible will be two essential drivers of growth. This is where three important KPIs come into play: your customers’ average Lifetime Value (LTV), your average Customer Acquisition Cost (CAC) and your LTV to CAC ratio.

What is the Customer Lifetime Value (LTV), and what is it for?

LTV is a KPI that measures how much money a customer brings into your company over the entire time they do business with you. This metric is calculated from three other metrics that are readily available in any company that has been running for at least a couple of years.

You calculate the LTV by dividing the average net monthly revenue per customer (which you get multiplying the average monthly revenue per customer by the gross margin percentage) by the monthly churn rate:

LTV= (Gross Margin % x Avg. Monthly Revenue from each customer)/Monthly Churn rate

As its name indicates, the LTV directly measures how much each customer is worth to your business in the long term.

What is the Customer Acquisition Cost or CAC and what is it for?

The CAC is basically what you need to spend to get each new customer. This translates to the average sales and marketing cost per customer, which is calculated by dividing your total expense in sales and marketing by the total number of new customers, or:

CAC = Monthly sales and marketing expense for new customers / Total number of new monthly customers

This metric is inversely related to how effective your marketing is. The higher the number, the more expensive getting each customer, so your marketing efforts are less effective.

When setting up the commission structure for your affiliate program, you can determine how much each new customer will cost you because you set that up from the start. Whether or not it makes sense to set it up higher than your current CAC or not depends on the following metric.

What is the LTV to CAC ratio and what is it for?

Finally, the LTV:CAC ratio is a crucial indicator that measures the efficiency of your marketing efforts. It determines how much bang you’re getting for your buck in terms of what you spend on sales and marketing. This is because this ratio tells you how much net dollar value you get for every dollar spent acquiring a new customer.

The LTV:CAC ratio tells you if there is room for improvement and if you should or shouldn’t allocate more of your company’s resources to marketing strategies such as an affiliate marketing program.

What is a good LTV: CAC ratio to launch an affiliate program?

You would typically want the LTV:CAC ratio to be as high as possible, right? Not necessarily. It depends on the phase of your company’s lifecycle you’re in. A high LTV:CAC ratio is great to increase profitability in an already established company, but if you’re looking for growth, too high a ratio means you’re spending too little in marketing and leaving opportunities for growth on the table.

A healthy ratio for a crypto company in the growth phase would be around 3:1. If your numbers are lower, you’ll want to look for ways to cut costs or to increase customer retention. This is not the ideal scenario to launch an affiliate program because you would likely have to offer lower commissions that will be unattractive to publishers.

However, if your LTV:CAC ratio is something like 5:1 or higher, there’s an opportunity for you to launch an affiliate program offering juicy rewards that will have affiliate marketers fighting over a chance to join.

Now that you know if it’s time to set up your affiliate program or not, and you’ve defined the resources you’re willing to allocate to the program, here are 3 keys to make your crypto affiliate program successful.

If you’re new to affiliate marketing you might feel a bit lost when you are just starting out. That’s why top affiliate tracking software is essential. Instead of using several different tools which takes up all of your time, instead use a turnkey all-in-one solution to track commissions, conversions and affiliate-related. We recommend Tapfiliate for this.

Never used Tapfiliate to track affiliate performance? Try all the features: ?get a 14-day free trial here

Key #1 – Target the right affiliates

Remember that, through an affiliate program, you plan on reaching your target audience through the content an affiliate marketer publishes. Therefore, you’ll really be reaching your affiliate’s audience. This is why it’s essential to start the process by ensuring your affiliate’s audience is aligned with your target audience.

In the case of crypto, statistics show that crypto investors are getting younger and younger every day. In the U.S., the percentage of investors ages 18 to 34 who are likely to purchase bitcoin in the next five years increased from 32% to 55% between 2017 and 2020.

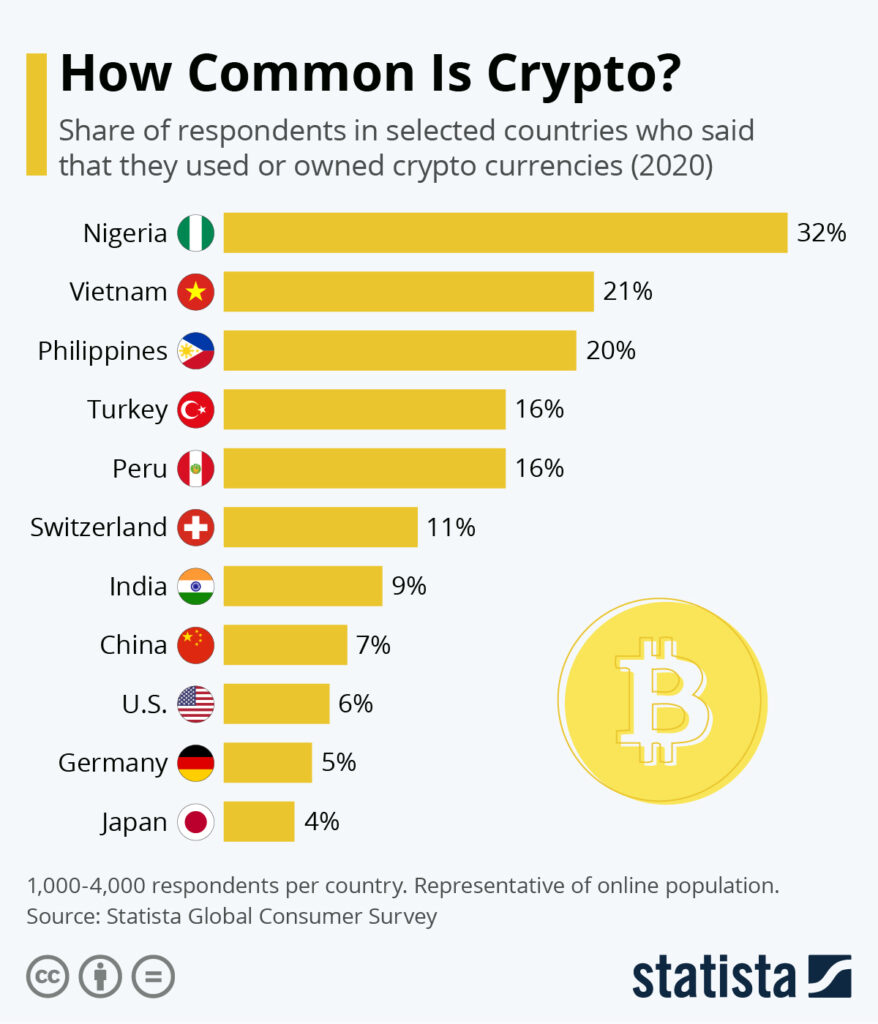

In terms of geographic location, Nigeria shows the largest proportion of people who currently use or own crypto thanks to the difficulty and high costs of traditional cross-border transactions. The African nation is followed by Vietnam, the Philippines, Turkey, and Peru.

What all this tells you is that, if you want to launch an effective crypto affiliate program, you should target publishers and creators whose readers mostly belong to that age group and/or come from those countries.

Key #2 – Offer to pay upfront

Once you find your potential affiliates, you need to attract them with a good offer. A key insight is that most publishers aren’t interested in receiving a percentage of fees for the lifetime of the customer. This is a somewhat common offer made by crypto exchanges. They just want to be paid upfront. The problem with the first option is that, while it has the potential to produce a large amount of revenue for the affiliate if the customer uses the service a lot, it could also go the other way around.

If you offer to pay for future performance instead of upfront, affiliates won’t have a clear idea of how much your affiliate program will really be worth to them. On the other hand, by offering to pay them upfront, you’re giving publishers more precise information now that will help them compare programs more accurately and ultimately make better decisions.

Key #3 – Sponsor content regularly

Finally, a third key insight that will let you gain publisher’s and influencer loyalty is to sponsor their content regularly. This not only ensures that your affiliate’s audience is getting the marketing copy or content you want (since sponsoring gives you a bit more control on the content being published) but it also opens a second source of revenue for your affiliate, which they’ll surely appreciate.

If you’re unsure what type of content to sponsor, look at what’s already working. For example, many affiliates in the industry have found success writing about the specific process for buying altcoins like Safemoon and Dogecoin, while others focus more on the technology behind the coins. As always, aim to collaborate with sites whose audiences overlap strongly with yours to ensure you get the best bang for your buck.

The bottom line

The keys to running a successful crypto affiliate program start by checking the performance of your current marketing efforts and determining if you’re in a position to invest in the program. Once you’ve established that and you’ve defined how much you can spend on the affiliate program, success comes down to finding the right affiliates and offering them a good deal with the right conditions.

Paying up front instead of after every transaction is more attractive to publishers, even if it means losing the chance to earn big on a few high-value leads. This alone can be a deal maker for the right affiliate. Furthermore, by sponsoring content regularly you not only help increase the effectiveness of your affiliate’s marketing efforts, but also gain more loyalty from your affiliate network.

Jordan Bishop

Jordan Bishop is a personal finance expert and travel hacker who holds a degree in finance and entrepreneurship from Wilfrid Laurier University, Waterloo, Canada. He is the founder of Yore Oyster and How I Travel, two sites to help you optimize your finances while living an international life. He recently published his first book, Unperfect, an exploration of problem-solving.